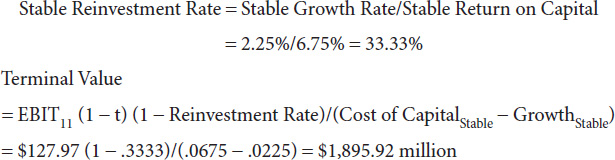

Reinvestment rate formula

With this data it is then a fairly easy exercise to track a casinos player. The Modified Internal Rate of Return MIRR 1 is a function in Excel that takes into account the financing cost cost of capital and a reinvestment rate for cash flows from a.

How To Use Reinvestment Rate To Project Growth For Valuation

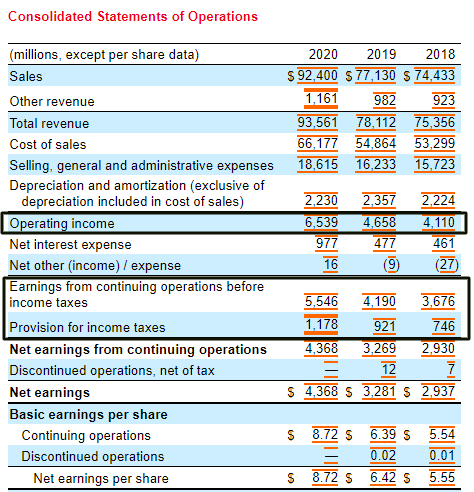

Divide the companys capital expenditures by the net income to determine the reinvestment rate.

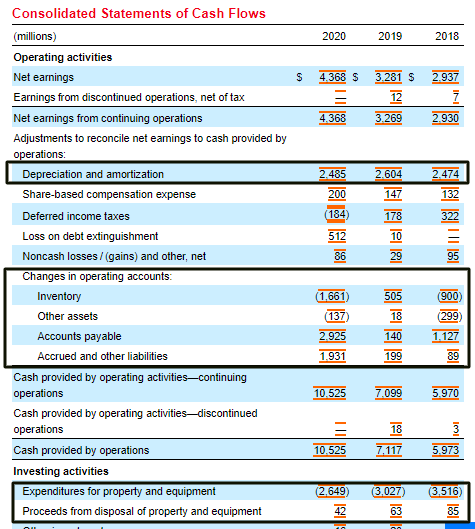

. The cost of investment can either be the total amount of assets a company requires to run its business or the amount of financing from creditors or shareholders. Assuming theres no other. Reinvestment Rate CAPEX DA Working Capital EBIT 1-t This way rather than projecting each individual component of reinvestment separately we can combine.

Reinvestment rate refers to the rate at which cash flows from an investment can be reinvested into another. 1 day agoAug 30 2022 Reinvestment rate risk is the risk that an investor will have to reinvest future cash flows at a lower return due to interest rate declines. For example if a company has 100000 in net.

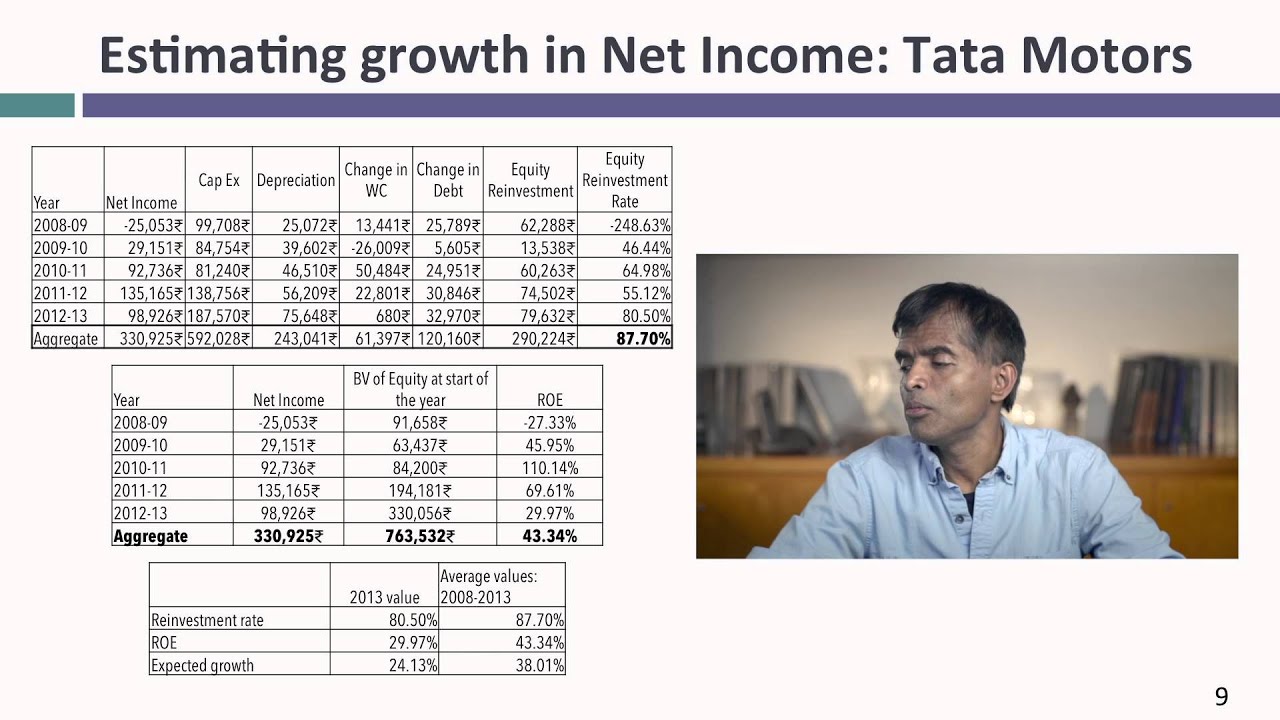

The ratios are already summarizing over their respective periods. Growth rate can be estimated it does not tell you much about the future. It is also the amount of interest that an investor can earn when the.

Reinvestment rate risk is. Cash Reinvestment Ratio Increase in Fixed Assets Increase in Working Capital Net Income. Brought to you by Sapling.

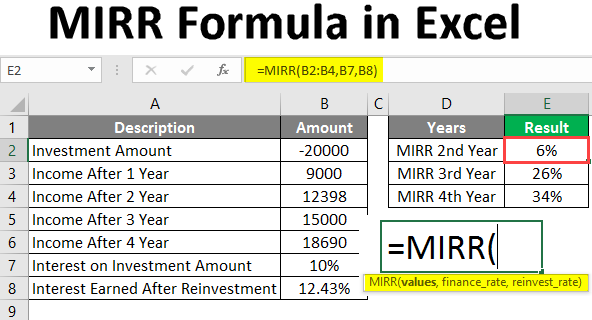

It can be calculated using the following formula. If you want the past growth rate youll need that specific periods ROIC and reinvestment rate. MIRR value_range finance_rate reinvestment_rate Where Value range The range of cells containing cash flow values from each period Finance rate The cost of capital of the firm or.

Aswath Damodaran 8 The Effect of Size on Growth. Equity reinvested in business Capital Expenditures Depreciation Change in Working Capital New Debt Issued Debt Repaid Dividing this number by the net income gives us a much. For a more real-world example consider a Company XYZ bond with a 10 yield to maturity.

The total of these various player reinvestment costs makes up the numerator while the denominator carded win. The formula for the cash reinvestment ratio is. Formula The equation for the cash reinvestment ratio is as follows.

Increase in fixed assets Increase in working capital Net income Noncash expenses Noncash sales - Dividends Example. Callaway Golf Year Net Profit Growth Rate 1990 180 1991 640. The financial management rate-of-return formula still assumes Ryan will reinvest the entire 300 per month.

Cash reinvestment is a term used to describe the change in retained earnings over a certain period of time. The formula assumes a reinvestment rate of 15 percent which is highly unlikely. If he chooses to invest it in a CD that pays 4 then his reinvestment rate is 4.

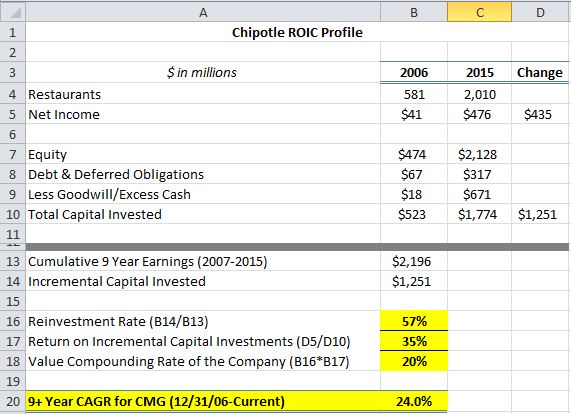

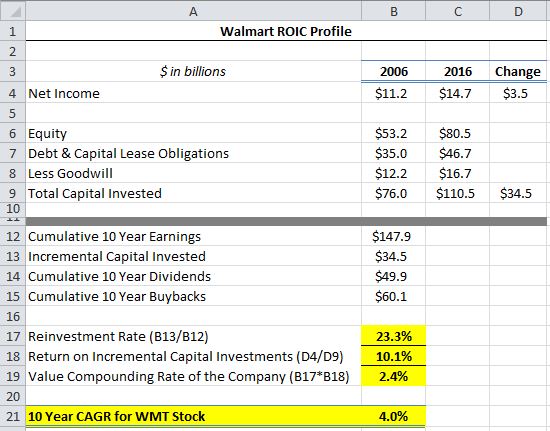

Calculating The Return On Incremental Capital Investments Saber Capital Management

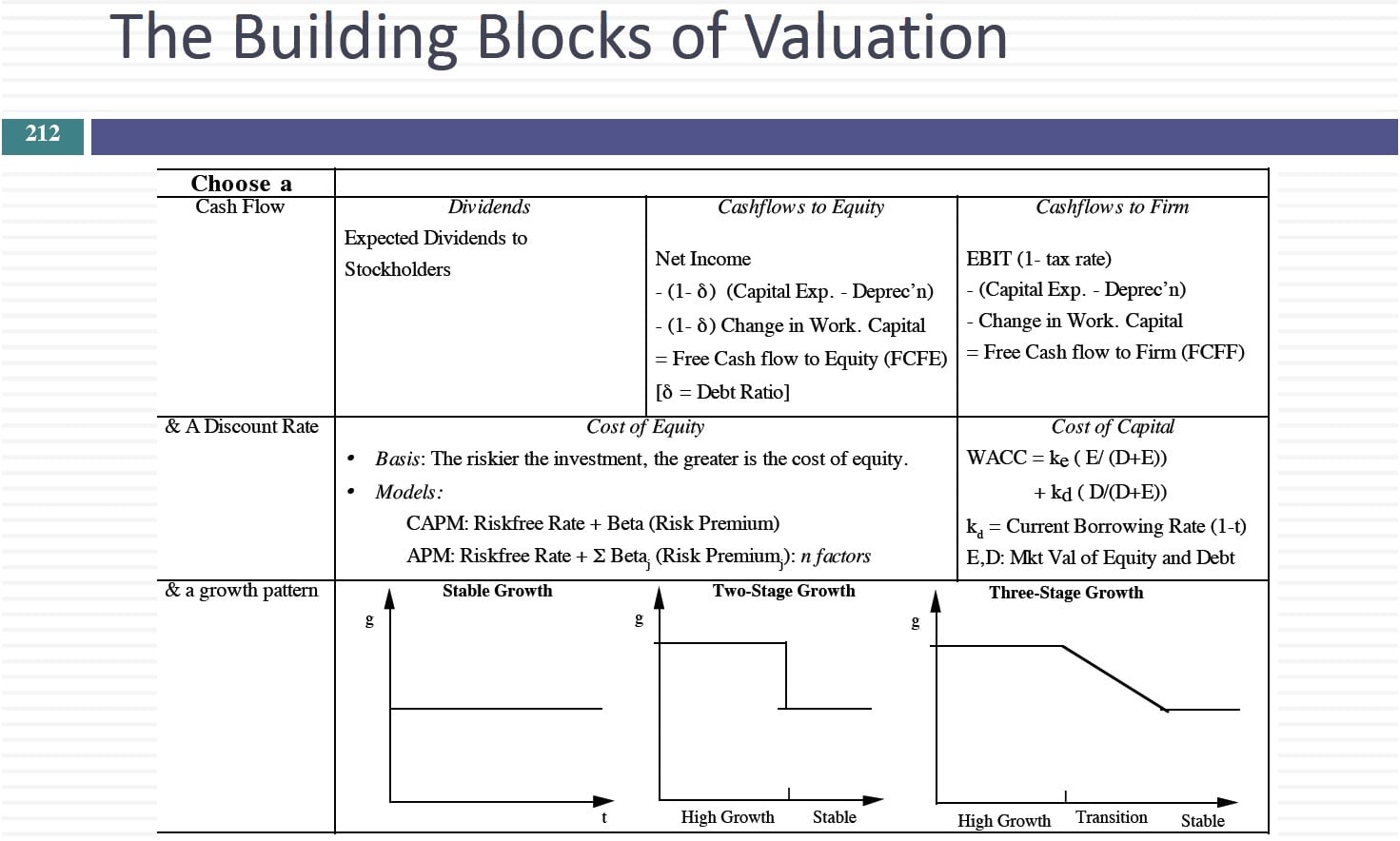

Corporate Valuation Free Cash Flow Approach Ppt Download

Why Net Depreciation From Capex For Computing Reinvestment Rate

Level I Cfa Tutorial Fixed Income Reinvestment Assumption In Calculating Yield To Maturity Ytm Youtube

The Light Side Of Valuation How To Value Growth Companies Informit

How To Use The Excel Mirr Function Exceljet

Reinvestment Rate Formula And Example Calculator Excel Template

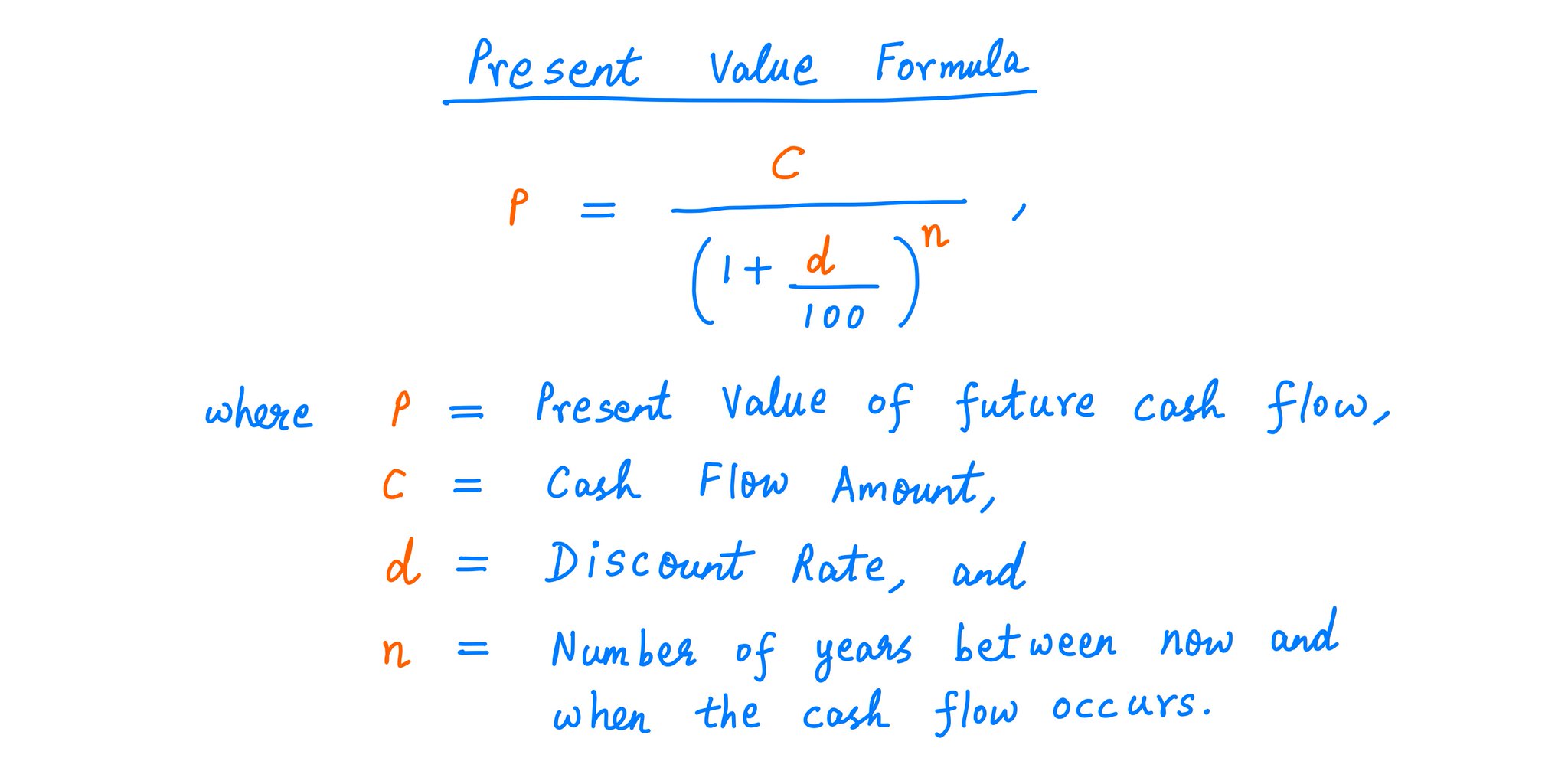

10 K Diver On Twitter 13 Here S A Formula To Calculate The Present Value Of A Future Cash Flow Along With A Couple Examples As You Can See The Formula Takes A Cash

The Ultimate Guide To Advanced Discounted Cash Flow Analysis Dcf How To Value A Company Stockbros Research

Calculating The Return On Incremental Capital Investments Saber Capital Management

Reinvestment Rate Formula And Example Calculator Excel Template

Session 10 Growth Rates Terminal Value Model Choice Youtube

How To Use Reinvestment Rate To Project Growth For Valuation

Session 31 Cash Flows Growth Rates Youtube

The Fundamental Determinants Of Growth

Reinvestment Rate Terminal Value Model Choice

Mirr Formula In Excel How To Use Mirr Function With Examples